Insurance is an essential financial tool that provides protection against financial loss or risk. Whether it’s insuring your home, car, health, or life, insurance helps reduce the financial burden caused by unexpected events. In this article, we will explore what insurance is, the different types of insurance available, and answer some frequently asked questions to give you a clear understanding of this critical subject.

What is Insurance?

Insurance is a contract between an individual (or entity) and an insurance company, in which the insurer provides financial protection or reimbursement for specific risks in exchange for regular premium payments. Essentially, insurance serves as a safety net for individuals and businesses, allowing them to manage the financial impact of unforeseen events, such as accidents, illnesses, natural disasters, or death.

The key elements of an insurance policy are:

- Premium: The amount paid periodically to the insurer for coverage.

- Policyholder: The individual or entity who owns the insurance policy.

- Beneficiary: The person or entity designated to receive benefits or payouts from the insurance policy.

- Deductible: The amount the policyholder must pay out-of-pocket before insurance coverage kicks in.

- Coverage Limit: The maximum amount the insurer will pay for a covered event.

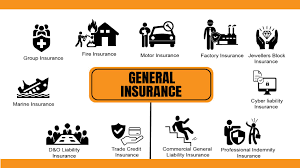

Types of Insurance

There are various types of insurance that cater to different aspects of life and business. Here are the most common ones:

1. Health Insurance

Health insurance helps cover medical expenses for illnesses, injuries, and surgeries. It may also cover prescription drugs, preventive care, and mental health services. Health insurance policies can be provided by employers, purchased individually, or obtained through government programs like Medicaid or Medicare.

2. Life Insurance

Life insurance provides a financial payout to the beneficiaries in case of the policyholder’s death. This payout can be used to cover funeral expenses, pay off debts, or provide financial support to the policyholder’s dependents. Life insurance comes in two main types:

- Term Life Insurance: Provides coverage for a specific period (e.g., 10, 20, or 30 years).

- Whole Life Insurance: Offers lifelong coverage and often includes a cash value component that grows over time.

3. Auto Insurance

Auto insurance provides protection against financial loss in case of an accident, theft, or damage to your vehicle. In most places, having car insurance is mandatory. The main components of auto insurance include:

- Liability Coverage: Pays for damages to others in an accident you cause.

- Collision Coverage: Pays for repairs to your car after an accident, regardless of fault.

- Comprehensive Coverage: Covers non-accident-related damages, such as theft or natural disasters.

4. Homeowners Insurance

Homeowners insurance protects your home and its contents from damages due to risks like fire, theft, vandalism, and natural disasters. It can also provide liability protection in case someone is injured on your property. There are different types of coverage depending on the policy, such as:

- Dwelling Coverage: Protects the structure of your home.

- Personal Property Coverage: Protects your belongings, such as furniture and electronics.

- Liability Coverage: Covers injuries to others on your property.

5. Travel Insurance

Travel insurance offers protection against unexpected events that can affect your trip, such as trip cancellations, lost luggage, or medical emergencies while traveling. It can cover:

- Trip Cancellation/Interruption: Reimbursement for non-refundable expenses if you must cancel or cut short your trip.

- Medical Coverage: Emergency medical and evacuation coverage while traveling.

- Lost Luggage: Compensation for lost or delayed baggage.

6. Disability Insurance

Disability insurance provides income replacement if you are unable to work due to illness or injury. There are two main types:

- Short-Term Disability Insurance: Offers temporary income replacement for a short period (usually up to 6 months).

- Long-Term Disability Insurance: Provides income replacement for a longer duration, often until retirement age.

7. Business Insurance

Business insurance covers various aspects of a business’s operations, protecting against risks like property damage, liability claims, and employee injuries. Some common types of business insurance include:

- General Liability Insurance: Protects against lawsuits for injury or damage caused by your business.

- Workers’ Compensation Insurance: Covers medical expenses and lost wages for employees injured on the job.

- Property Insurance: Covers damage to business property, including buildings, equipment, and inventory.

Benefits of Insurance

Insurance offers numerous advantages that can significantly reduce financial stress during difficult times:

- Risk Mitigation: Insurance helps protect you from the financial impact of unexpected events, such as accidents, illnesses, or natural disasters.

- Peace of Mind: Knowing that you are financially protected in case of emergencies can provide peace of mind.

- Financial Security: Life insurance, health insurance, and disability insurance provide financial security to your loved ones in the event of your death or incapacity.

- Legal Protection: Auto insurance, liability insurance, and workers’ compensation insurance offer legal protection in the event of accidents or lawsuits.

- Tax Benefits: Some types of insurance, like life insurance and health insurance, may offer tax benefits depending on your location.

Risks of Insurance

While insurance can provide significant benefits, there are some risks to be aware of:

- High Premiums: Depending on the type of insurance, premiums can be expensive, especially if you opt for higher coverage limits or have certain risk factors.

- Exclusions and Limitations: Insurance policies often have exclusions, meaning certain events or situations may not be covered. Always read the policy details to understand the scope of coverage.

- Claim Denials: Insurance companies may deny claims if the event isn’t covered under the terms of the policy, if you fail to meet the deductible, or if there is insufficient documentation.

FAQs about Insurance

1. How do I choose the right insurance policy? To choose the right insurance policy, assess your needs, lifestyle, and budget. Consider the type of coverage you need (e.g., health, life, auto) and compare different insurers to find a policy that offers the best value. It’s also important to read the policy terms to understand what’s covered and what’s not.

2. What is the difference between term life and whole life insurance? Term life insurance provides coverage for a specific period (e.g., 20 years) and is usually more affordable. Whole life insurance offers lifelong coverage and may include a savings or investment component, allowing the policy to build cash value over time.

3. Can I change my insurance policy after I purchase it? Yes, most insurance policies can be modified after purchase. You can adjust coverage limits, add or remove beneficiaries, or switch providers. However, changes may result in different premiums or coverage terms, so it’s important to review the details before making any adjustments.

Conclusion

Insurance is an essential part of financial planning, offering protection against a wide range of risks. Whether it’s safeguarding your health, home, or business, having the right insurance policy can provide peace of mind and financial security. Before purchasing any insurance, take the time to understand the different types available and ensure the policy fits your needs and budget.